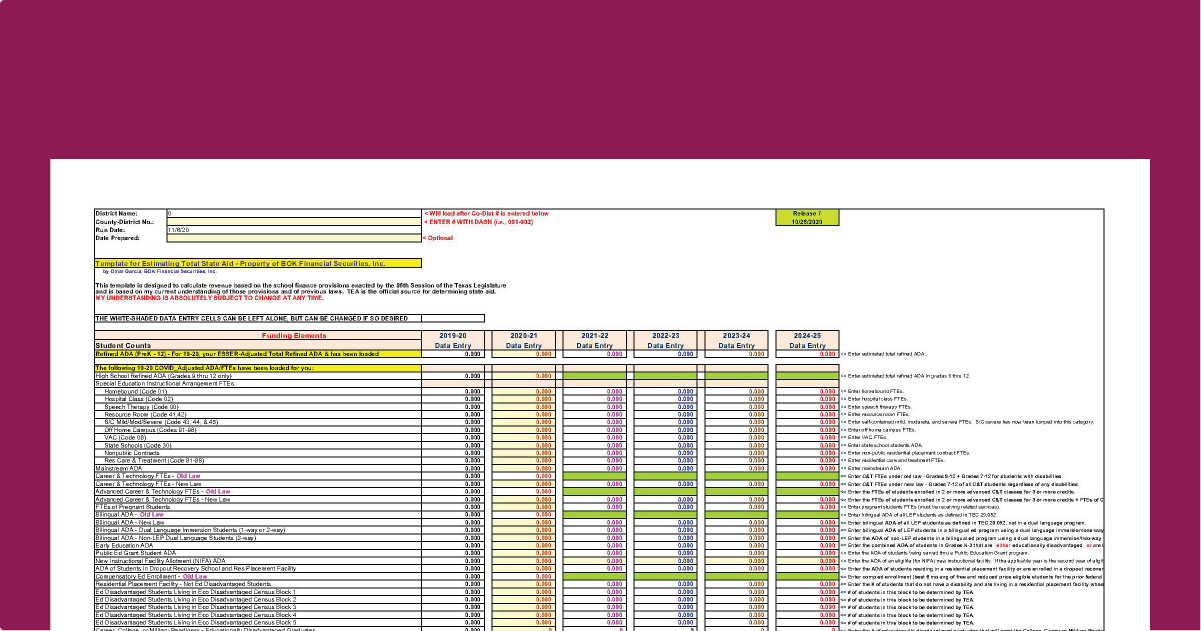

Template for Estimating State Aid

This Excel template is designed to help develop annual budgets, monitor over/under state aid payments during the year, and for long-range planning, as it typically gives users the ability to project state aid for at least four subsequent school years. Developed and maintained by Omar Garcia of BOK Financial Securities, Inc., we are the sole source provider of this template and have been granted permission to share exclusively.

Current Release:

Release Date: R6, SS#4 (Release 6, Special Session #4) 04/05/2024

This release is just an update now that TEA has incorporated all three of the I&S hold harmless calculations into their latest 2023-24 Summary of Finances. The template’s results will match TEA’s results for all three given the same data. As always, stay tuned for further developments.

Previous Versions:

R5, SS#4 (Release 5, Special Session #4) 03/05/2024 fixes issues with the TEC 48.283 allotment for all non-recapture districts and now should match TEA’s results using the same data. As always, stay tuned for further developments.

R4, SS#4 (Release 4, Special Session #4) 02/27/2024 fixes issues with all of the M&O hold harmless calculations and should match TEA’s results using the same data. As always, stay tuned for further developments.

R3, SS#4 (Release 3, Special Session #4) 02/14/2024 only applies to certain districts – errors have been corrected related to the Fast Growth Allotment and the Additional State Aid for Certain Districts Impacted by Compression. If your district does not get either one of these allotments, it is not necessary to run this release. As always, stay tuned for further developments.

R2, SS#4 (Release 2, Special Session #4) 02/12/2024 updates all the M&O hold harmless calculations to reflect TEA’s methodologies used on their updated Summary of Finances dated 2/9/24. Pleas read the Notes tab for other changes. As always, stay tuned for further developments.

R1, SS#4 (Release 1, Special Session #4) 02/01/2024 loads the Comptroller’s preliminary values for tax year 2023 and the “near final” data for the 2022-23 school year. It also tacks on another year (2027-28). Please read the notes, as there are still a couple of issues yet to be resolved. As always, stay tuned for further developments.

R5, SS#2 (Release 5, Special Session #2) 08/01/2023 fixes issues related to the Rate to Maintain and the Notice tabs. As always, stay tuned for any further developments.

R4, SS#2 (Release 4, Special Session #2) 07/24/2023 fixes various issues that have cropped up since Release 2 dated 07/18/2023 was posted. Please read the ‘Notes’ tab to see the types of changes that were made and note the pending issue that relates to certain 22-23 recapture districts. As always, stay tuned for any further developments.

R3, SS#2 (Release 3, Special Session #2) dated 07/20/2023 Please disregard this version – the wrong file was linked for that posting.

R2, SS#2, (Release 2, Special Session #2) dated 07/18/2023 reflects provisions in SB 2, as adopted by the 88th Texas Legislature, Second Called Session, and incorporates the required tax compression, the increase in the homestead exemption, and the M&O and I&S hold harmless provisions as I currently understand them. As always, stay tuned for any further developments.

SR#2 (Special Release #2) dated 06/15/2023 is current law, and fixes the problems with the Rate to Maintain tab. As always, stay tuned for any further developments.

SR#1 (Special Release #1) dated 6/12/2023 is current law, and includes the increase in the golden penny yield from $98.56 to $126.21 that was also adopted in the General Appropriations Act. For you 7/1 districts, that is all you have to go on right now. As always, stay tuned for any further developments.

Archive:

Archived versions are available on the Template for Estimating State Aid Historical Archive page.